Getting Prepared for the Year-end:Maximizing the Value of Compensation Surveys

Financial institutions have been spending substantial monetary and manpower resources on compensation surveys every year. However, this has become a mundane annual exercise rather than one that facilitates decision making.

For years, compensation surveys have served as an important source of competitive market data to deal with the challenges in attracting, motivating and retaining talent. During the economic turmoil in 2008/09, critics doubted the value of the market data by arguing that firms should be more internal rather than external focused and gave more consideration to affordability. Nevertheless, except for 2009 (i.e. right after the economic crisis), compensation survey participation has not been affected and, in fact, has increased slightly each year. The key issue is not the data itself but how to extract the relevant data by using a tailor-made approach to address and support individual firms’ unique situations for sound business and compensation decisions.

HR often faces the daunting task in interpreting market data and extracting the relevant information from the survey reports of more than 50 pages. Sometimes critical market information can be “hidden” in the immensely large spread-sheet amidst the other market information which is just “nice-to-have”. During the peak of the year-end processes, HR simply cannot afford the resources to extract the meaningful and relevant information from the compensation surveys. Therefore, some firms would choose to outsource to a third party partner part or all of the preparation for the year-end compensation papers. This can further add to the credibility of market data as Business Heads might prefer a neutral third party to make sound judgment in interpreting the market data to serve the business needs.

The quality and credibility of market data might be questioned when Compensation Specialists or Business HR Partners fall into one of the following pitfalls according to our experience:

§ Job Matching– Not enough due diligence has been spent on the job matching exercise. With the generic or mysterious benchmark descriptions that never seem to fit, they can be like a jigsaw puzzle which HR personnels are pulling their hair out to complete the matching. Sometimes, HR might take a simple approach by mapping jobs purely based on titles, but this could be absolutely misleading when firms do not have a consistent job levelling approach or titling structure for different departments. The situation could be even worse when survey consultants do not possess the necessary business and compensation knowledge. As such, the entire job matching exercise is just a “garbage in, garbage out” process without any relevant business context and possibly skewing the survey results.

§ Internal/External Changes– When firms submit data in the second quarter and get the survey data back in the third (or even fourth) quarter, there is a time lag of five to six months which diminishes the usefulness of the survey data. Survey data needs to be projected based on the latest market environment and firm performance to make it relevant to the business for compensation decisions.

§ Multiple Data Sources –Some clients tend to participate in multiple compensation surveys conducted by different vendors. This could be triggered by the need in serving different local/regional and headquarters’ requirements or finding alternative data sources for “cross references”. Unfortunately, this might result in a struggle to reconcile the information due to different survey methodology and data structure. The situation is worsened when the survey findings contradict with each other.

§ Limited Internal Resource– Firms tend to have very stretched resource in dealing with data issues especially during the year-end compensation process. Even though there is the aspiration of transforming the HR function into a true business partnership to manage the continuously high regulatory and business demand, HR professionals found it difficult to squeeze extra time for reviewing the market data in a manner that would draw meaningful insights for advising the business on strengthening the linkage between productivity and rewards.

HR could avoid the above pitfalls and maximize the value of compensation surveys by:

§ Providing due diligence of job matches to enhance survey data quality;

§ Actively monitoring market competitiveness with key market gaps analysis & insights; &

§ Engaging competent resources to facilitate preparation for the year-end compensation review and bonus proposal to Remuneration Committee/Senior Management.

Case Study

A leading regional firm with multiple business lines engaged us to conduct compensation positioning analyses by businesses / functions / levels to identify gaps from a Total Compensation perspective. This provided valuable insights on the department and employee levels that needed special adjustment to address pay competitiveness. The project also included conducting market bonus differential analyses across businesses to support decision making on bonus allocations.

Here are some illustrations on such kind of high-level analysis to provide meaningful insights to drive business decision:

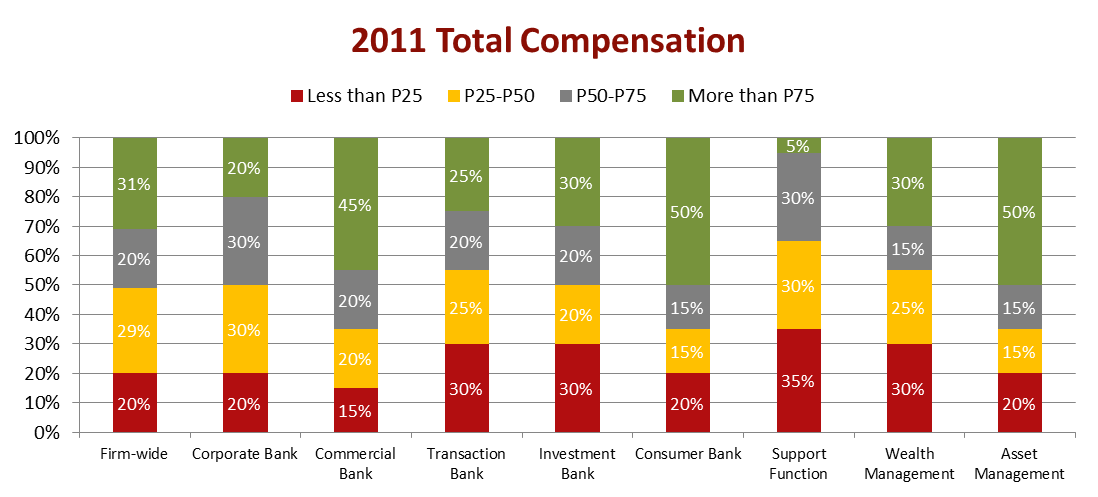

1. Total Compensation Positioning– this analysis provided a snapshot on the competitive posture of different departments by identifying the percentage of population that falls into different compensation positioning percentile bucket.

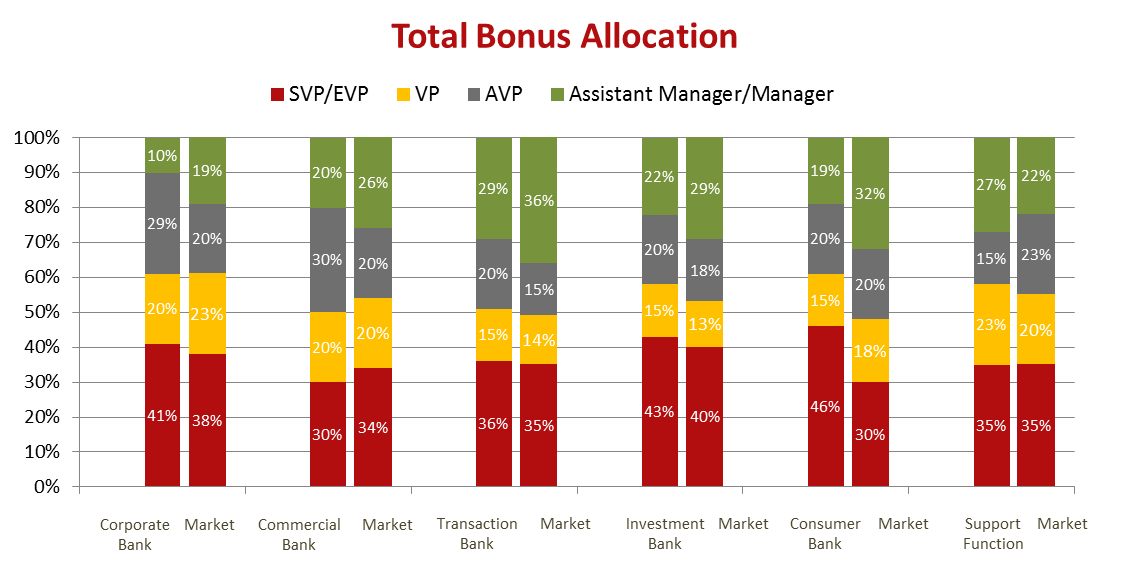

2. Compensation Allocation Analysis– this analysis compares and contrasts bonus allocation across different business/function units of the firm versus the market.

We have also performed other kinds of analyses which are tailor-made to individual firms’ unique requirements, and helped firms apply market data for other compensation related projects, e.g. bonus gap analysis and salary band review. The key emphasis is to ensure there is high qualitymarket data which serves as the cornerstone of all comparisons and recommendations.

About the CFFS Value-added Data Services

CFFS consultants have strong experience in translating survey data into a valuable decision making tool through our end to end services. We make use of our strong and dedicated Financial Services experience to rationalize survey data from different survey vendors. In additional to our niche advisory work, we partner with our clients in extracting and interpreting survey data so as to get prepared for the compensation reviews and year-end compensation process. To further explore how we might partner with you to add value to your survey data, please contact us as below:

Eric Chia (This email address is being protected from spambots. You need JavaScript enabled to view it.) – 65 6589 0668 Ext. 133

May Poon (This email address is being protected from spambots. You need JavaScript enabled to view it. ) – 65 6589 0668 Ext. 129

Robert Li (This email address is being protected from spambots. You need JavaScript enabled to view it.) – 65 6589 0668 Ext. 128

About Carrots for Financial Services (CFFS)

Carrots For Financial Services (“CFFS”) is an Asian-based niche consulting firm focusing on compensation, performance and productivity advisory services specifically for the financial services industry in South Asia. It is a joint venture between Carrots Consulting Pte Ltd and Pretium Partners Asia Limited. Our senior consultants have in-depth expertise in compensation review and design, serving Board and Remuneration Committees for major financial institutions in the region. This experience combined with Carrots Consulting's expertise in long term incentive design and share valuations, provides a differentiated niche in compensation and performance advisory services to the industry at large.